123 44th Street, Union City, NJ

Messrs. Kimche and Shneyder partnered to assemble and re-zone a 20,000 SF development site located in Union City, NJ. Construction culminated with the successful development of a nine story, 140,000 SF apartment building. The property, named One23 after its address, contains 80 units plus a 106-space indoor parking garage. Offering excellent accessibility to New York City and the greater Northern New Jersey suburbs, the property is considered one of the most desirable residential buildings in the area providing first-class amenities including a state-of-the-art gym, landscaped common outdoor sun deck, and electronic entry system. Units showcase designer finishes, featuring LED lighting throughout, stainless steel appliances, NYC views, private terraces, oversized bathrooms and windows and a washer/dryer in each unit. Upon completion, the property achieved nearly 100% occupancy and was subsequently sold to an affiliate of Harbor Group International.

Downtown Rochester, NY

Mr. Shneyder acquired an 80,000 Sq Ft office complex in downtown Rochester, NY that had served as regional headquarters of the General Accident Insurance Corp (NYSE: OB). In two stages, he gut renovated the buildings and converted them to luxury multi-family apartments. The properties currently contain a total of 57 units. The first, known as Industrie Lofts, contains approximately 44,000± sf, with 21 residential units. The second, known as Riverview Lofts, consists of a six-story elevator apartment building, with approximately 36,000± sf. This building contains (6) studios, (26) one-bedroom units and (4) two-bedroom units. The project’s amenities include an exclusive residents-only media room and gym, two underground parking garages, central air conditioning, storage, laundry facilities, on-site management and a building superintendent. Both buildings have a loft aesthetic with exposed brick, high ceilings and exposed ductwork. The projects received overwhelming support from the city of Rochester and County of Monroe IDA (COMIDA). The project was sold to Buckingham Properties for the highest price per unit ever recorded at that time for a multifamily sale in downtown Rochester, New York core.

610-612 Clinton Street, Hoboken, NJ

Known as “The Castiron”, this 14-unit loft condominium project was developed by Mr. Kimche from the combination of two former spice warehouses. The adjacent buildings were connected and the rear of the ground floor was demolished, creating private gardens for the lower floor units, while relocating the floor area to the roof to construct penthouses with expansive roof decks and views of the Manhattan skyline. Interiors offered ceiling heights ranging from 10 to 16 feet, with direct elevator entry and finishes equivalent to those found in the best Tribeca loft conversions of the day. The project set price records for Hoboken at the time of its sell out.

https://streeteasy.com/building/610-clinton-street-hoboken#tab_building_detail=4

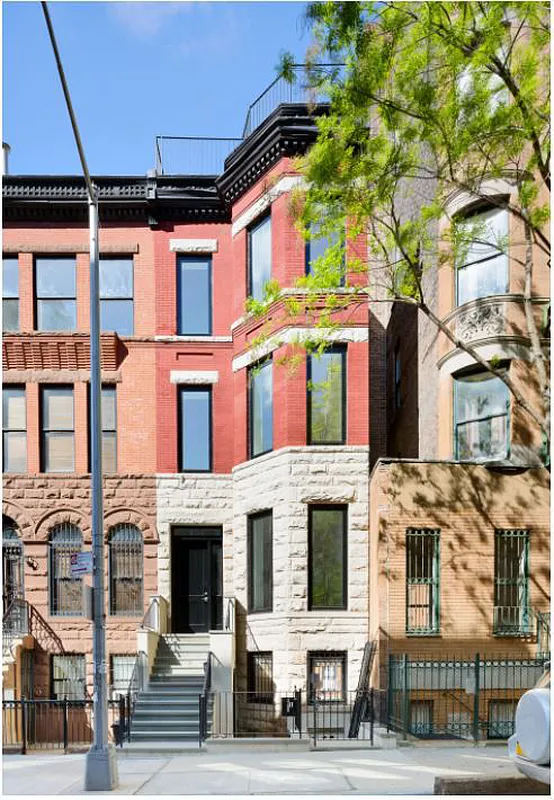

305 West 112th Street, Harlem, NY

Mr. Kimche partnered with a local contractor to reimagine a former SRO walk-up in a rapidly gentrifying section of Harlem in close proximity to both Central Park and Morningside Park. The property was completely gutted, structurally repaired and expanded both in footprint and in height. The resulting duplex condo units offered a garden triplex with an entry below the stoop and an upper triplex with a penthouse and roof deck. The cellar was excavated to create a habitable living space with garden access and the rear façade received a glass curtain wall. Interior finishes were carefully selected to provide luxurious finishes appropriate to the market. The ultimate buyers relocated from Tribeca and the West Village, two of the most popular and expensive areas of Manhattan, which was a testament to the appeal of the product.

https://streeteasy.com/building/305-west-112-street-new_york#tab_building_detail=2

Single Family Home Developments

After completing a deed in lieu of foreclosure, Mr. Kimche took title to three partially constructed homes in the Hamptons. Two of the homes were relatively modest, by Hamptons standards, and were approximately 80% completed. Those were completed and sold quickly. The third home, located on a 2 acre estate lot in Amagansett, had only just begun. Mr. Kimche retained the services of a local builder and completely redesigned the floorplans, landscape plan and finishes. The home was sold just before the pandemic induced spike in the Hamptons market.

https://www.zillow.com/homes/15-Bittersweet-Ln-Amagansett,-NY-11930_rb/32661554_zpid/

https://www.zillow.com/homes/53-whooping-hollow-rd_rb/111532680_zpid/

https://www.zillow.com/homedetails/55-Whooping-Hollow-Rd-East-Hampton-NY-11937/32663216_zpid/

6Hundred Tower Apartments, Worcester, MA

Messrs. Kimche and Shneyder purchased Skymark Tower Apartments, a 206-unit Class-B multifamily property built in 1991 and located in Worcester, Massachusetts, one hour west of Boston. The Property, since rebranded as the 6Hundred, is centrally located near employment generators, universities, and entertainment destinations. The Boston MSA has benefited from over a decade of strong population growth and continues to enjoy job growth at rates that exceed the national average. After the initial closing, the partnership was restructured to bring in Benedict Canyon Equities, Cypress Equities and DVO Real Estate. The partnership implemented a value-add business plan, upgrading amenities and renovating units. The asset is currently stabilized.

Revel Apartments, Aurora, Colorado (Denver MSA)

Messrs. Kimche and Shneyder purchased a fully approved development site slated for ground up construction of a 300-unit luxury apartment complex. After the initial closing, the partnership was restructured to bring in Cypress Equities and DVO Real Estate as Co-GP members along with an institutional preferred equity investor. The project is located in Aurora, a booming suburb of Denver. It consists of five separate apartment buildings and a clubhouse that offers a gym, workstations, an outdoor pool and a jacuzzi. The property has achieved stabilization and the partnership still holds the asset.

Industrial Sale/Leaseback, Buffalo, New York

Messrs. Kimche and Shneyder acquired 8 acres of land with an approximately 145,000 SF manufacturing/industrial/office facility located in Buffalo, New York. The property was sold by Buffalo Wire Works (BWW) as part of that company’s financial strategy and leased back under a twelve-year triple net lease. The asset offered ceiling heights up to 40 ft and was situated adjacent to railroad tracks with a spur directly into the facility. BWW is a century old manufacturer of metal screens used in a variety of industrial applications. The property was held for five years and ultimately sold back to BWW when it received local tax incentives.

195 Chrystie Street, Manhattan

This nine-story,100,000 RSF loft building offers studio space for nearly 100 tenants from the world of fashion, film, photography and design. Mr. Kimche repositioned this asset, located east of SOHO in the rapidly gentrifying Lower East Side, from a garment factory building into one of the most sought after centers of creativity in Manhattan. New York Magazine once described the building as “The highest concentration of design genius in the city.” The recently renovated lobby pays homage to The Talking Heads, whose band originated within the building, with a large neon sign that reads “THIS MUST BE THE PLACE”. The property enjoys nearly 100% occupancy, even in the post pandemic environment.

18 West 27th Street, Manhattan

This twelve-story, 33,000 RSF loft building located in the heart of NoMad is undergoing a major capital improvement campaign overseen by Mr. Kimche. Building wide upgrades include a new storefront, lobby, elevators, windows, sprinkler system, fire system and restored façade, all executed in coordination with the NYC Landmarks Preservation Commission. The boutique nature of the property presents smaller commercial tenants with a unique opportunity to achieve full floor status while enjoying privacy and abundant natural light. New York City’s Open Streets program has recently expanded to include the NoMad Piazza, a pedestrian plaza with a thriving outdoor dining scene along Broadway just steps from the property. Upon completion of the improvements, the building will be among the highest caliber of all boutique office buildings in the market and already enjoys 100% occupancy.

8 East 36th Street, Manhattan

This five-story,12,500 RSF building offers loft/office space convenient to both Grand Central and Penn Station. The ground and second floors are leased to an Irish pub and the upper floors are occupied by the union representing the electrical workers of Con Edison, which acquired the building from Mr. Kimche in 2022.

Summerlake Apartments, Murfreesboro, TN

Together with an operating partner, Mr. Kimche acquired this 1988 vintage asset in the suburbs of Nashville. The property has 176 spacious townhouse style units which had been operated by local ownership, leaving a projected 37% increase in rents on the table. Mr. Kimche and his partners will overhaul the parklike lakeside property and renovate interior finishes to modern standards. While the Nashville multifamily market remains a high growth area, Murfreesboro is one of the more affordable submarkets. As part of the acquisition, Mr. Kimche and his partners assumed a 3.17% fixed rate loan with seven years of term remaining.

Fairway Meadows Apartments, Smyrna, TN

Together with an operating partner, Mr. Kimche acquired this twenty year old asset in the suburbs of Nashville and began to implement a value-add business plan. The property has 208 townhouse style apartments, which had been owned and operated previously by a mom and pop landlord for many years, leaving units unrenovated and rents well below market. The property is undergoing a common area upgrade and individual units are leasing after renovations at an average rent increase of 59% over outgoing leases. Occupancy is running at over 95%.